Maple Insurance & Risk AIMS (Assess, Identify, Market, Secure and Service) high when placing your cover

Maple Insurance & Risk AIMS high when it comes to securing the best insurance solutions for our clients — no matter the size of your business or the difficulty of the risk. We’re advice-driven, not sales-driven, relationship-focused, not self-serving. The outcome? Tailored and appropriate solutions to your business needs.

But the process to achieving the right outcome for our clients isn’t as straightforward as often assumed — it’s actually more of a continuum. First, we Assess and manage any new or changing risks in your business, then we Identify insurance solutions for risks that can be transferred to insurance companies. Next, we go to the insurance Market where we have access to over 180 insurers, to Secure your cover and place your insurance program specific to your business risk.

Let’s look at why the process is so effective and each stage in more detail.

Why conduct a business insurance risk review

When it comes to business insurance, a set it and forget it approach is never favourable. Your business is changing, the industry is fluctuating, the market is shifting, and technology is advancing — so your risk is constantly altering. Your insurance needs keep pace with these changes.

Reassessing if your business insurance protections remain not just adequate, but optimal, provides important advantages to support business success.

A business insurance risk review can:

- Identify gaps in your cover: Your insurer will consider whether your cover takes your risks into account and if you’re at risk of non-insurance, or under insurance (when the sums insured are set too low).

- Address exclusions in your policies: A risk review will identify the specific risks that won’t be covered in case of an event, and work to ensure these are addressed through additional means.

- Alert you to new risks in your operations: Your business, the industry and the market are constantly adapting, and your insurer should make you aware of how each change will impact your operation.

- Assist with securing optimal coverage: By identifying gaps, exclusions and emerging risks, your insurance needs are thoroughly identified and will be used to secure optimal coverage.

- Unlock potential savings: Previously insured events may become obsolete, your risk may have reduced or increased, premium rates and insurers aspiration for your business may have changed — all having the potential to unlock potential savings in your insurance. These savings may not have been unlocked if you had gone ahead and renewed your current policy without taking a sequential approach with your broker.

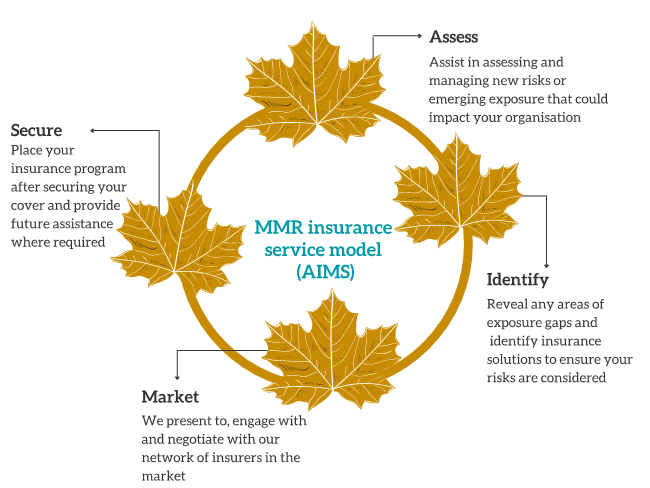

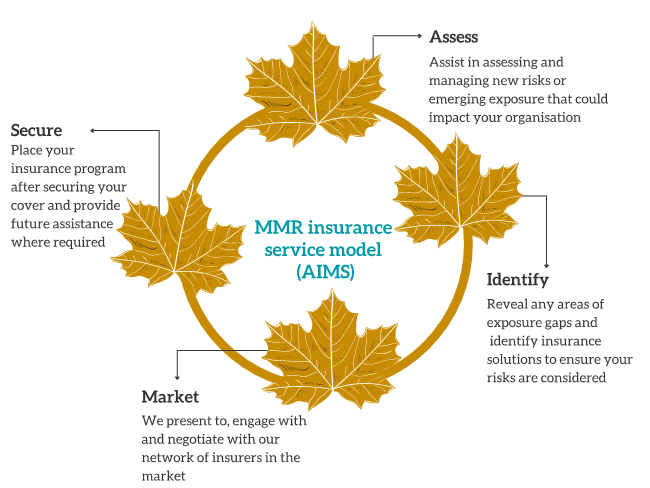

Our insurance service model – AIMS

Our expert brokers tackle business insurance renewals using our AIMS client continuum — aiming to achieve the best possible outcomes for your business. Key steps in working to achieve optimal business insurance renewals are outlined below.

Assess (risk)

We begin by assessing any new or emerging risks that impact your business. It could include economic, environmental, technological, legal factors and beyond. The risk management review and insurable risk review will reveal your top risks, key risks and core insurable risks. For example, could the adoption of new technology as a result of remote working in your business be increasing the risk of data leaks or cybercrime? If so, you may need additional business controls and cyber insurance to adequately protect your business. By assessing new risks or emerging exposures, brokers can understand your individual needs and move on to identify whether your current cover is adequate.

Identify (gaps)

Next, we need to Identify any areas of cover or new policies that do not meet your business risks or identify new policies that should be covered. Would your business be able to survive a critical incident with its current insurance cover? Are your insurance policies the best fit for your current business risks or do specific areas of cover need to be improved? Our gap analysis will dive deep into a situational analysis to stress test your insurance program and understand what needs to be purchased for your risks to be mitigated.

Market (to insurers)

We’ll then go to the insurance Market. We work with you to present your insurance needs to potential insurers in a tangible manner that will resonate and be attractive. This stage involves developing a market engagement strategy, placement strategy and creating underwriter presentations to best achieve the preferred program in the market. When we enter the insurance market, we develop competitive insurance programs by presenting your risk exposures to the right people within the best-suited insurance companies that have an interest in helping you. We’ll present your risk in the best light, using our experience and knowledge to negotiate a positive outcome.

Secure (cover) & Service

Finally, we Secure your cover and place your insurance program specific to your business risk. The process we undergo to get to this point ensures that your solutions will be fit for purpose, safeguarding your businesses future. Importantly, it doesn’t just stop there. Our experts continue to work in partnership with your business and provide our Service when required — from day-to-day assistance, regular meetings, policy maintenance and claims management. And, when it is time for a review, we’ll leave no stone unturned when reviewing your insurance program in the current market, to ensure the process delivers results and the best achievable outcome.

The Maple difference

At Maple Insurance & Risk, our goal is to challenge the current state and deliver fresh ideas and innovative solutions and services to our customers.

We’re here to protect our clients’ current and future viability by identifying their risks and finding effective risk and insurance solutions. We do this through the storytelling of our client’s management approach to the right people in the market.

Our solutions are highly tailored and always appropriate, which is made possible through our advice-driven, customer-oriented, and long-term approach. Our secret? Everyone at Maple shares the same belief — by empowering and taking care of our clients, the leaves fall into place.

Get an insurance review or quote

We would be happy to discuss your needs, assess your current insurance solution and provide you with a quote. Just contact us here.

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Maple Insurance & Risk

Level 17, Angel Place

123 Pitt Street

Sydney NSW 2000

info@mapleinsurance.com.au

(02) 8329 0999

Site map

Maple Managed Risk Pty Ltd trading as Maple Insurance & Risk is a Corporate Authorised Representative of Insurance Advisernet Australia Pty Ltd. AFSL No. 240549.

Corporate Authorised Representative No. 1288279. Visit the Insurance Advisernet website.

Privacy | FSG | Disclaimer | Consumer Advice | Compliments & Complaints

Website by Businessary