General Insurance Premium Pricing May 2023 – Outlook for 2023/24

As your dedicated insurance representative, we’re constantly monitoring the insurance market to better understand and assess insurance trends and how they may affect your business.

Firstly, having the correct sums insured for the current replacement value of your building, contents and machinery is crucial. The recent impacts of inflation, labour shortages, persistent lower AU$ at around 0.70 Cents to US$ (April 2023) and supply chain issues have caused a dramatic increase in the costs to rebuild/repair properties and replace items. It’s important that we work together to ensure you have the correct valuations and sums insured for your insurance policies.

As your adviser, we recommend that property and other asset values be reviewed regularly to ensure you’re adequately insured. Having incorrect insured values could result in any claim being adjusted due to underinsurance, meaning you’ve paid less than what you need to replace your property. Having a professional valuation will help to prevent this. We can arrange access to experienced quantity surveyors that can accurately confirm building rebuild costs for commercial and domestic buildings, in addition to plant & machinery.

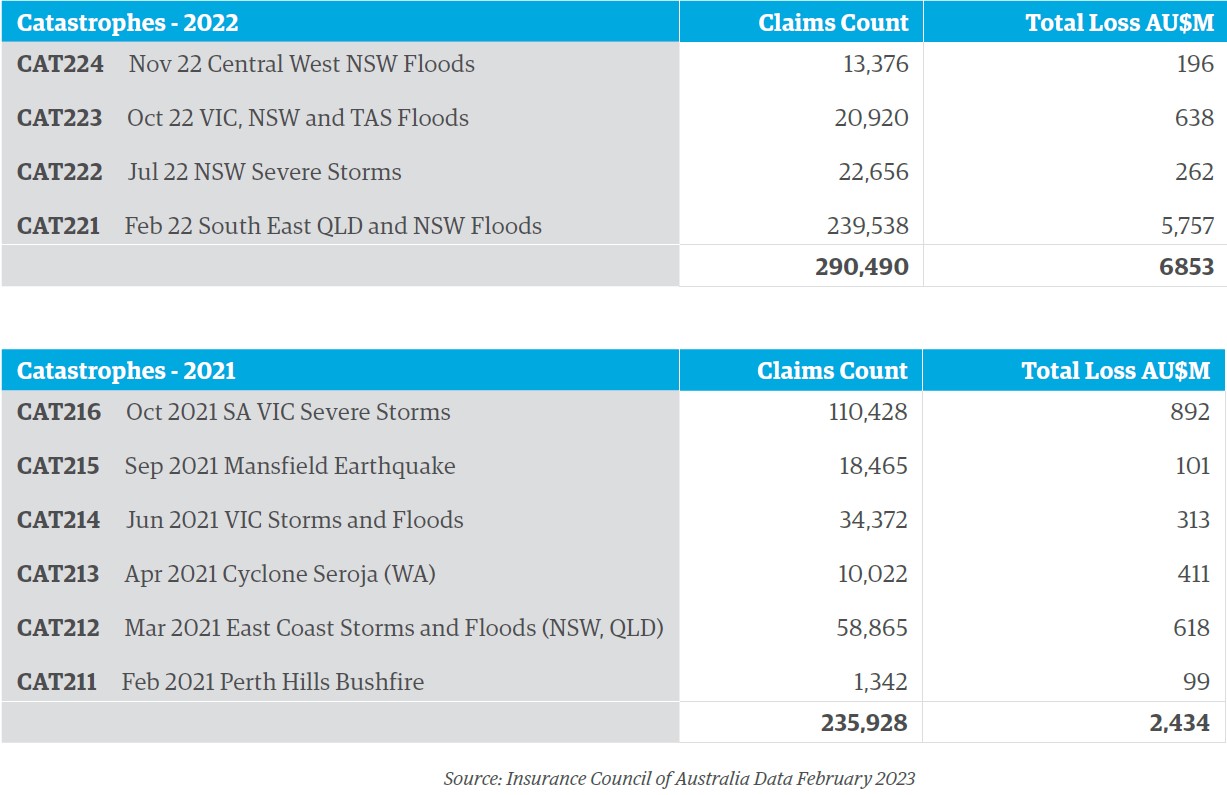

Over the last two years, Australia has had an extremely high frequency of catastrophe events, as shown in the tables below. The South East Queensland and New South Wales Flooding event is now Australia’s costliest Insurance Catastrophe. This event has had over 239,000 claims at a current estimate of AU$5.7B.

Pricing Outlook:

In summary, the following are the key “positives” and “negatives” that will impact insurance premiums in the foreseeable future over the next 12-18 months.

Positives:

- Continued improved profitability of insurers on the back of higher premium prices

- Bureau of Meteorology is now predicting a weakening of La Niña conditions which resulted in well above average rainfall

events, as many of us were impacted by over the last few years.

Negatives:

- Extreme weather events still likely (El Niño watch continues)

- Increased Reinsurance rates for Catastrophe insurance that Insurers purchase, due to the significant weather related claims that occurred in 2022

- Continuing inflation impacting sums insureds, rebuilding costs coupled with persistent lower AU$.

One of the key drivers for Insurers’ improved profitability in 2022 was the release of significant claims reserves that were provisioned for business interruption claims that were lodged as a result of the impact COVID had on many businesses. The High Court decision handed down in October 2022 favoured insurers, and hence, they could release claims reserves that had been held pending the outcome of this High Court decision.

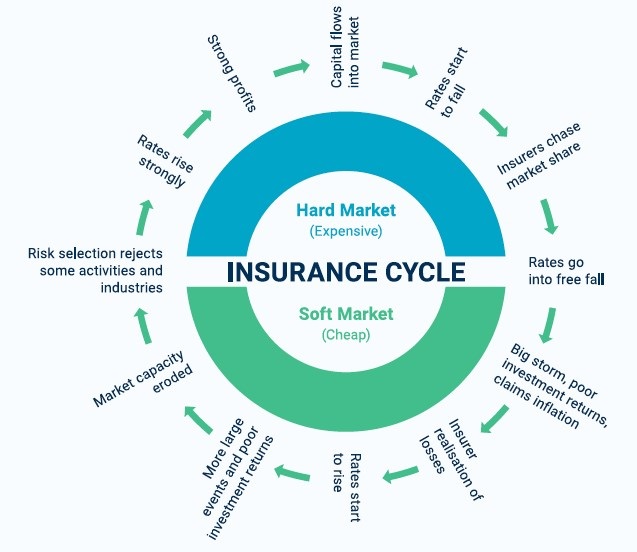

Given the large number of weather-related claims paid and increased reinsurance costs, pricing increases will continue on the same trajectory as we have seen over the last few years. The continued hard market will see average increases in the vicinity of 9% – 12% for commercial insurance, 15%+ for property risks, including home, and a motor increase of 7%+, with some potential easing of liability/professional line classes due to the longer-term improved outlook for investment returns on reserves held for liability classes of insurance, particularly if inflation does reduce, lowering the impact of claims inflation on claims reserves held by Insurers.

With the continuing hard market, we anticipate:

✓ Continued period of higher or increasing premiums

✓ Getting insurance coverage could remain a challenge and get harder to negotiate terms

✓ Insurers still reducing capacity with some risks or industry groups or clients with prior claims

✓ Higher excesses

✓ Focus on risk management and mitigation processes

✓ More time and additional information required to place or renew insurance.

Looking to the future

The insurance industry, we believe, is at 10 o’clock on the insurance clock. How long it remains there largely depends on the frequency and severity of future catastrophic events. It’s clear, without corrective action, the industry cannot sustain continual year-on-year catastrophic events whilst still providing cover for ‘usual’ loss events. We subsequently believe average premium increases will remain in the range of 8% – 12%. The exact figures will be influenced by industry sector, geographic location, prior claims experience and approach to risk management.

Structural change and cost cycles are part of every industry. The insurance clock is a useful tool to represent where insurance rates are right now and where they’re likely to be heading in the future.

Should you have any questions or would like to arrange a valuation or discuss any other general insurance needs, please don’t hesitate to get in touch. We’ll be very happy to help.

Get an insurance review or quote

We would be happy to discuss your needs, assess your current insurance solution and provide you with a quote. Just contact us here.

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Maple Insurance & Risk

Level 17, Angel Place

123 Pitt Street

Sydney NSW 2000

info@mapleinsurance.com.au

(02) 8329 0999

Site map

Maple Managed Risk Pty Ltd trading as Maple Insurance & Risk is a Corporate Authorised Representative of Insurance Advisernet Australia Pty Ltd. AFSL No. 240549.

Corporate Authorised Representative No. 1288279. Visit the Insurance Advisernet website.

Privacy | FSG | Disclaimer | Consumer Advice | Compliments & Complaints

Website by Businessary